trader tax cpa brian

Green prepares my 1120S return. Before we start in detail.

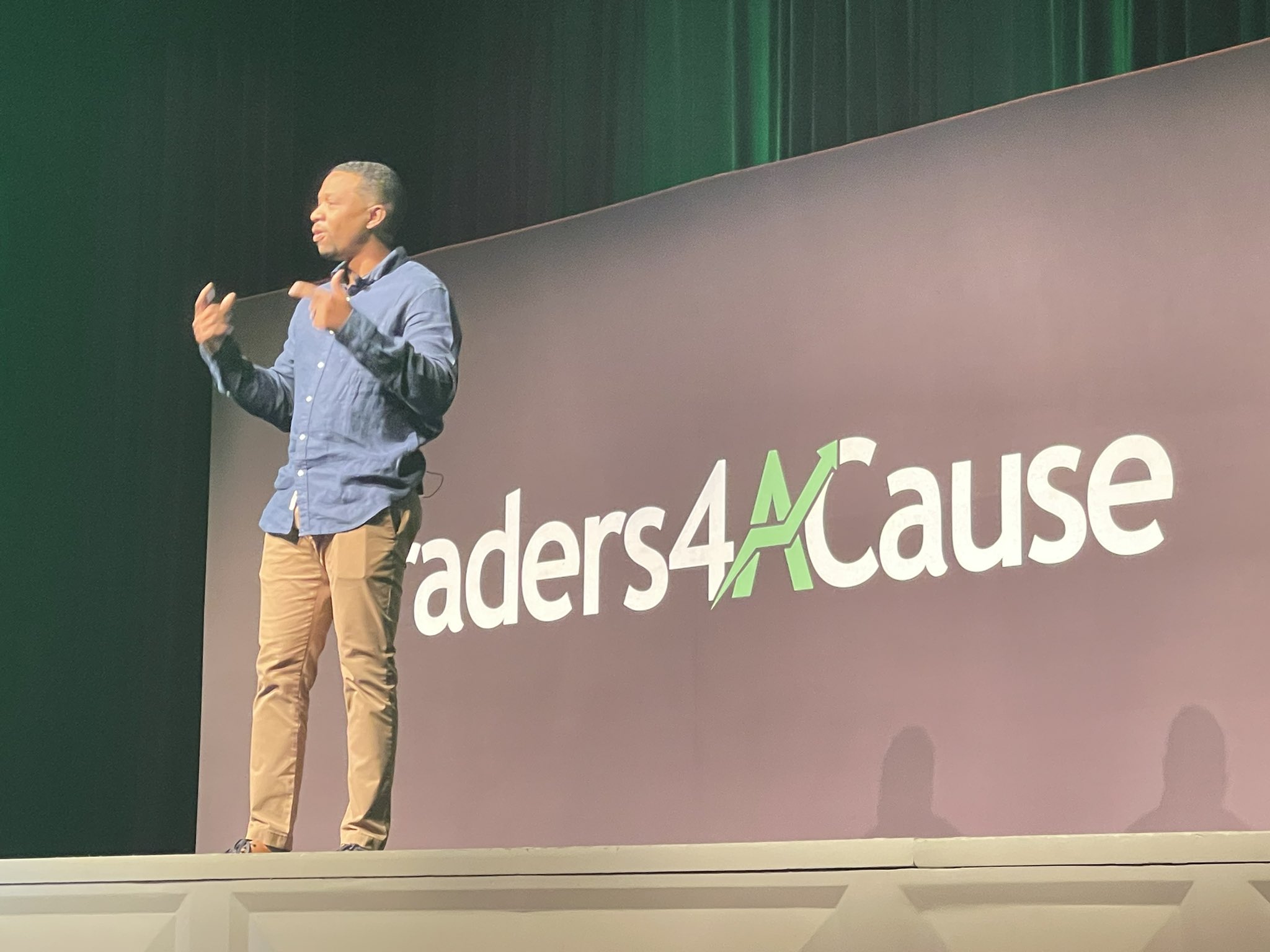

Brian Rivera Certified CPA and Managing Member of Trader Tax CPA.

. Being active traders and CPAs ourselves we understand the complexities of being. Day Trader Taxes Strategies and Debunking some of the Top 3 Tax Myths For Active Day Traders. Brian Maze Partner CPA Brian specializes in State and Local Tax compliance and serves as one of the firms lead contacts in the area of State and Local Tax.

Through use of the latest cloud technologies we are able to provide virtual services to clients across multiple states. I moved forward to being a site member. Being active traders and CPAs ourselves we understand the complexities of being a full and part-time Day Trader.

Through use of the latest cloud technologies we are able to provide virtual services to clients across multiple states. Green is the expert in the niche IMO. TraderTaxCPA LLC brings specialized industry expertise to cater to the active day trader to maximize tax savings.

I do my individual return. The latest tweets from tradertaxCPA. ProVision Financial Services LLC is an Orlando FL cloud-based Professional Services Firm.

They must report each securities trade and related wash-sale loss adjustments on IRS Form 8949 in compliance with section 1091 which then feeds Schedule D Capital Gains and. Ad Thumbtack - find a trusted Accountant in minutes. Monday to Friday.

Our mission is to leverage our tax expertise to help. I started by purchasing the trader tax guide. More than just filing paperwork we can also provide tax consultation and planning services to help you come up with a strategy to maximize your trading dollars year after year.

Through use of the latest cloud technologies we are able to provide virtual services to clients across multiple states. I didnt file 2017 taxes so Brian did a great job in assisting with making sure I reported all of my crypto transactions properly and leverage losses for future years. I like being hands on understanding tax code and how to comply.

For additional businesses real estate and investments the price will increase. Get a free estimate today. TraderTaxCPA is an Orlando FL cloud-based CPA Firm.

Trader Tax CPA Office. The Companys founder Al Davidson is a CPA with 25 years of experience in accounting tax and small business consulting. Whether you are a brand new trader or seasoned veteran taxes is never a one size all fits approach.

Accounting for trading gains and losses is the responsibility of traders. Ad A tax CPA can help simplify your taxes and get them done right. Brian Rivera Trader Tax CPA LLC CPA Trader Tax CPA LLC is an Orlando FL cloud-based CPA Firm.

His current clients include businesses in the contracting manufacturing distribution real. TAX PARTNER Brian Kern CPA TAX PRINCIPAL PRESENTATION TOPICS Research Development Federal RD Credits NYS RD Incentives New York State Excelsior program Investment Tax Credit Employment Incentive Credit 0 Corporate Tax Rate Other credits and incentives including the. Update October 21 2021.

Please let us know how we can help. Generally speaking an individual trader with 1-3 brokerage accounts over 1000 trades and one class of securities can expect to pay about 1497. Learn to Day Trade.

Progressing still further I purchased phone consultation which I still do for whenasif needed. Real prices from top rated Accountants near you. Pro Trader Tax is a virtual tax advisory firm specializing in tax planning and counselling tax preparation entity formation and retirement plan services for active business traders and investors.

I came across Trader Tax CPA through browsing the internet on CPAs who know how to record crypto losses. Trader Tax CPA LLC. February 8 2020July 11 2020beyondthetrades.

Compare - Message - Hire - Done. We seek CPA independent contractors to perform tax compliance services to our trader clients around the country who operate as sole proprietors partnerships and S-Corps. Trading is difficult enough so leave th.

Our mission is to help the everyday trader understand the complex rules about investor and trader tax statuses. Trader Tax CPA LLC. In this webinar I had the opportunity to discuss and debunk the Top 3 Day Trader Tax Myths and share a few real world case study examples with the trading education.

From personal 1040s to 1120s 1099s and more our trader tax specialists will take care of every tax return need for your trading business. In addition he manages tax compliance and planning relating to Partnerships S-corporations and Higher Wealth Individuals. QUESTION Thank you for taking the time to participate in the Q A session.

Tradertaxcpa Financial Consultant. Click here Brian began his public accounting career in 1986 and dedicates a majority of his time to the tax and accounting practice of the firm including audit review and compilation of financial statements and tax compliance and consulting services for business entities and individuals. Our goal is to make your accounting and tax needs less of a burden by providing services that allow you to.

Entity Selection Formation. CPA Tax Compliance For Traders Consider a remote CPA contractor position rendering tax compliance services to our trader clients. Lets work together to get your taxes filed and skip the stress.

Trader Accounting can be complex with cost basis reporting and wash sale adjustments across multiple brokerage accounts. Showing all 6 results.

Brian Rivera Certified Cpa And Managing Member Of Trader Tax Cpa Beyond The Trades

Save Money On Day Trader Tax 2022 With Cpa Brian Rivera Trader Tax Status Forming Llc Wash Sales Youtube

Save Money On Day Trader Tax 2022 With Cpa Brian Rivera Trader Tax Status Forming Llc Wash Sales Youtube